Endless Metrics provides quantitative analysis on the current, past, and future state of the market and economy. This analysis is produced with independence and objectivity for the benefit of individuals within the finance profession and for those outside of the industry seeking to learn more about the market.

Latest Content

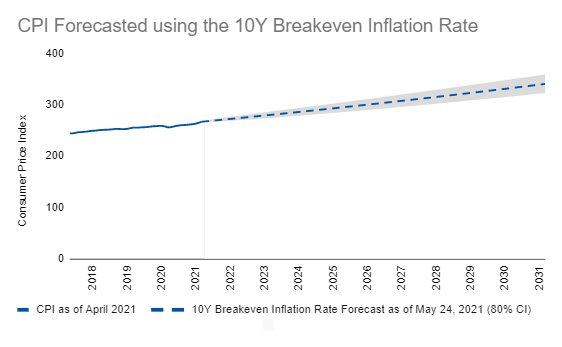

10Y Inflation Forecast

If we want to make a forecast for inflation, we can combine a historical measurement, such as the Consumer Price Index, with long-term expectations implied by the... (read more)

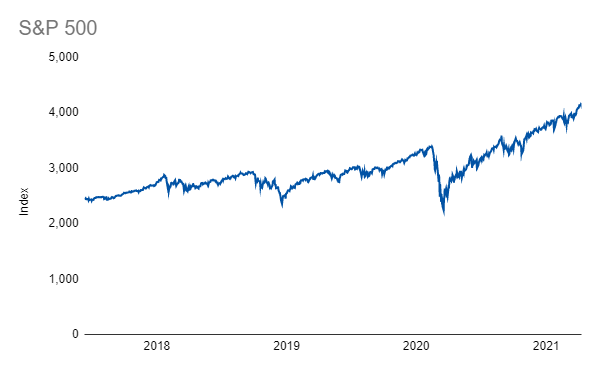

The S&P 500

The S&P 500 should need no introduction. Although the Dow Jones Index came first, the S&P 500 is pretty much the gold standard when it comes to market indices. Five hundred fundamentally solid... (read more)

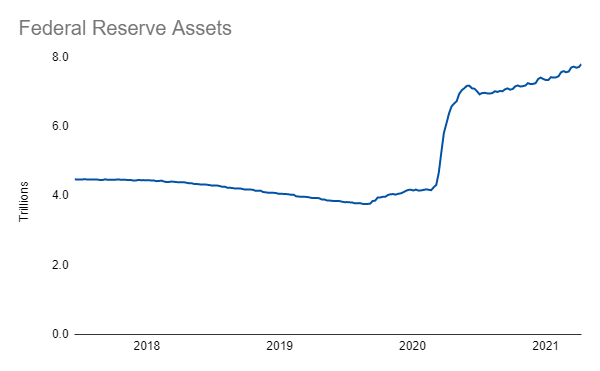

Federal Reserve Assets

Don't fight the Fed. That adage exists for a reason. During the last two crises the Federal Reserve stepped up in a big way to rescue the market. So, having an indicator to assess their actions is... (read more)

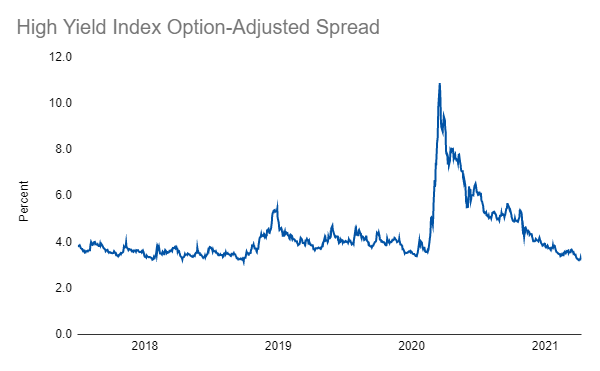

High Yield Spread

If you have a relatively safe investment, like a treasury note and a riskier investment, like a non-investment grade bond, you would expect a difference between the yields for each. Meaning, you would... (read more)

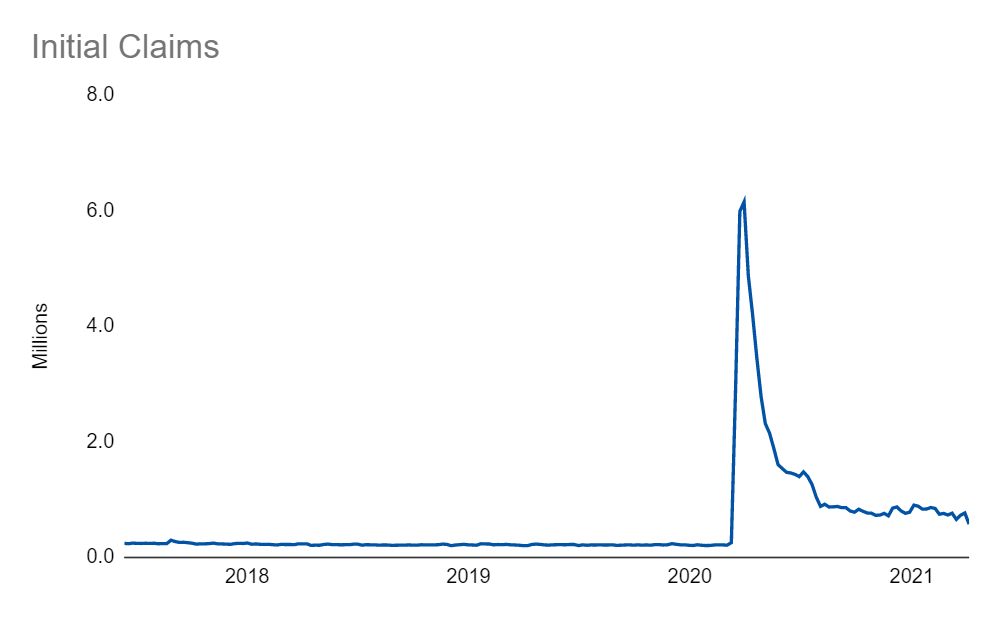

Initial Claims

Jobs are fundamental to both the stock market and GDP. If you don’t have jobs, you don’t have companies with stocks to trade. If you don’t have jobs, you aren’t producing any stuff that gets measured by... (read more)